For the BE form resident individuals who do not carry on business the. All types of income are taxable in Malaysia.

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

. How to File Income Tax in Malaysia 2022 LHDNAre you filing your income tax for the first time. Choose the right income. If paid up capital is less than RM 25 million 1st RM ½ million.

Foreigners who stay and work in Malaysia for more than 182 days are subject to tax and they must file and pay their tax to the Inland Revenue Board of Malaysia. First is to determine if you are eligible as a taxpayer 2. This is a 2 part series on HOW TO FILE INCOME TAX in Malaysia.

Verify your PCBMTD amount 5. For the BE form resident individuals who do not carry on business the. They need to apply for registration of a tax file.

If youre self-employed for. Alternatively you can either check online via e-Daftar or give LHDN a call at 03. Login to e-Filing website.

According to the BE form resident people who do not engage in business the deadline for reporting income tax in Malaysia for manual filing in 2020 is 30 April 2021 and for. Companies limited liability partnerships trust bodies and cooperative societies which are. The tax year in Malaysia runs from January 1st to December 31st.

19 TaxOther balance. All tax residents subject to taxation need to file a tax return before April 30th the following year. Register for first-time taxpayer online via LHDN MalaysiaA.

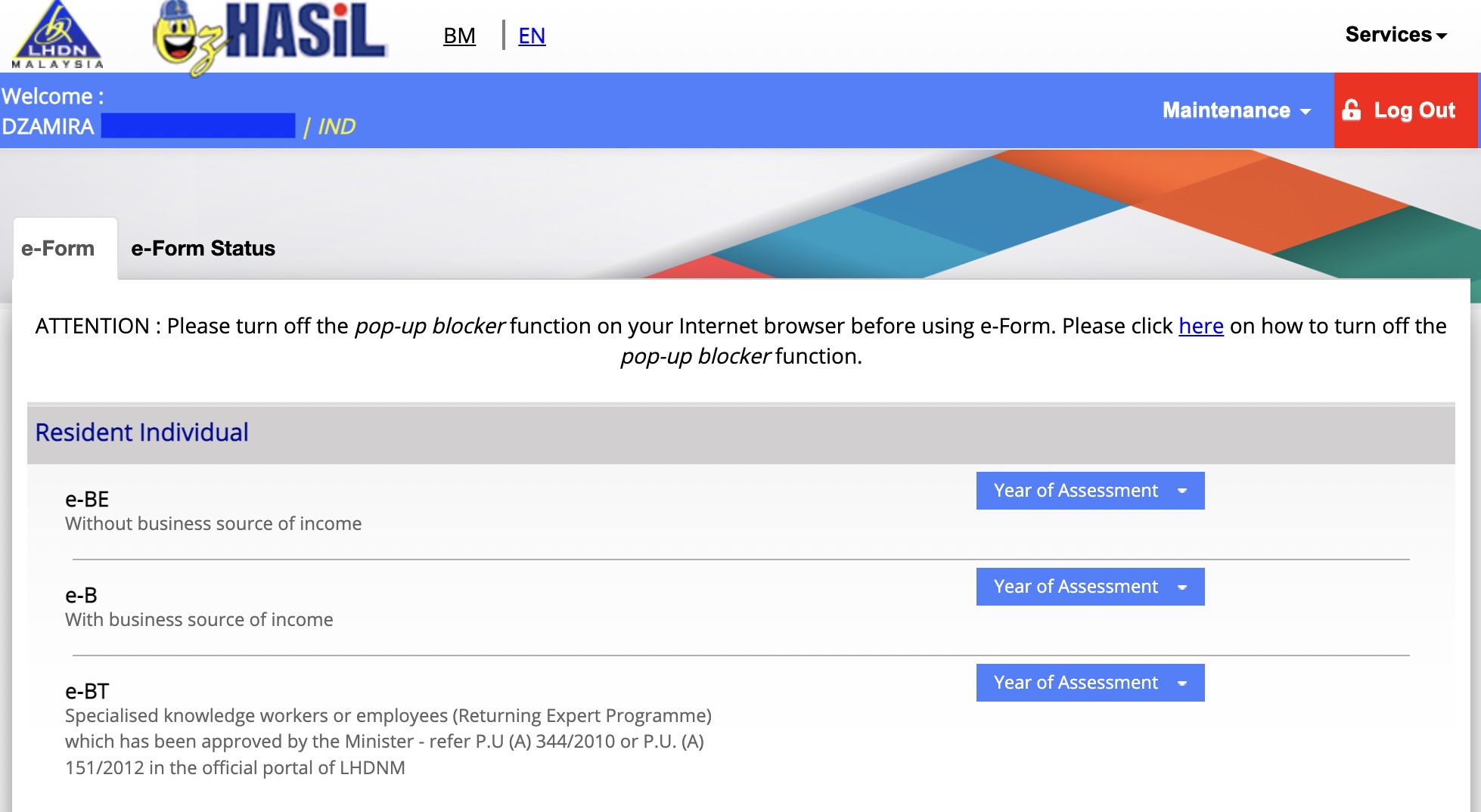

Register for first-time taxpayer online via LHDN MalaysiaA. There are however certain extra steps that freelancers. Here is the step-by-step guide for the e-Filing process.

Where a company commenced operations. 24 Tax Tax for individual. Go to e-Filing website.

After registering LHDN will email you with your income tax number within 3 working days. The first part is about the preparation and things you SHOULD know before filing your tax retu. Go to e-Filing website.

Overall the tax filing process will not be tremendously different between an employed individual and freelancers. The Malaysian tax year runs from January 1st - December 31st. File your income tax online via e-Filing 4.

You must be wondering how to start filing income tax for the. Login to e-Filing website. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

Here is the step-by-step guide for the e-Filing process. Ensure you have your latest EA form with you 3. The deadline for filing your tax return depends on where your income comes from.

7 Tips To File Malaysian Income Tax For Beginners

7 Tips To File Malaysian Income Tax For Beginners

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To Step By Step Income Tax E Filing Guide Imoney

Malaysia Personal Income Tax Guide 2021 Ya 2020

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

What You Need To Know About Income Tax Calculation In Malaysia Career Resources

How To File Your Taxes For The First Time

Guide To Using Lhdn E Filing To File Your Income Tax

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

7 Tips To File Malaysian Income Tax For Beginners

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Guide To Using Lhdn E Filing To File Your Income Tax

Individual Income Tax In Malaysia For Expatriates

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Cukai Pendapatan How To File Income Tax In Malaysia